HEALTH

Group Health Insurance Plans in Dallas: Affordable Coverage Options

When running a business in Dallas, offering group health insurance can feel like navigating a maze but think of it as your map to attracting and retaining great employees. Choosing the right health plan isn’t just about ticking off a requirement; it’s about creating a supportive environment that values employee well-being. Many small businesses have discovered that providing comprehensive coverage leads to happier, healthier workers who are more productive and loyal. The good news? There are plenty of options available that can meet both your budget and your employees’ needs, making it easier than ever to prioritize their health while boosting your company’s appeal in a competitive job market. Let’s dive into what group health insurance plans entail and how you can find the best fit for your team.

In Dallas, businesses can choose from various group health insurance plans offered by major providers such as Blue Cross Blue Shield, Aetna, Taylor Benefits, and UnitedHealthcare. These plans typically include a range of coverage options such as medical, dental, and vision care, catering to the diverse needs of employees.

Exploring Group Health Insurance in Dallas

Exploring Group Health Insurance in Dallas

Group health insurance provides a foundational element of security for employees in Dallas. It’s not merely a checkbox on an employee benefits form; it represents a commitment to the well-being of a company’s workforce. By offering these plans, employers foster a healthier workplace environment, leading to increased productivity and job satisfaction. Research shows that when employees feel secure about their healthcare, they tend to perform better at work and take fewer sick days.

In Dallas, the dynamics associated with group health insurance are particularly compelling. A staggering 60% of small businesses offer these plans, as highlighted by the Texas Department of Insurance. This statistic speaks volumes about the prevalence of coverage but highlights the growing understanding among companies that employee health is intrinsically linked to overall business success and morale.

The conversation often gravitates towards localized versus nationwide insurance plans. Localized plans may cater specifically to the unique medical needs and circumstances present in Dallas—allowing for tailored solutions such as specific specialists or relevant health initiatives. Nationwide plans can offer broader networks and potentially lower premiums, yet they may lack the personal touch that localized providers might afford. This ongoing debate underscores the need for businesses to evaluate what works best for them on a case-by-case basis.

When considering a group health insurance plan, it’s essential for employers to think beyond merely compliance with legal mandates; it’s also about nurturing an ethos that prioritizes employee well-being.

Employers in Dallas who invest in group health insurance often report enhanced employee loyalty and retention. When staff members see their employer taking care of their health needs, they naturally feel more valued. Furthermore, solid coverage helps attract top talent, as many workers actively seek out jobs that offer meaningful healthcare benefits. It boils down to creating a positive feedback loop: healthier employees often result in happier workplaces and greater productivity.

As we continue this exploration, it will be crucial to examine how these plans can yield significant advantages for employers while boosting overall company morale.

Benefits of Group Health Plans for Employers

Providing group health insurance can ultimately lead to a more engaged and loyal workforce. Beyond the increased retention rates, these plans signal to employees that their well-being is valued. When staff feel cared for, it fosters a sense of belonging and investment in the company’s success. This emotional connection isn’t just beneficial for morale—employers often see higher productivity levels as well. Employees who know they have access to health care are less likely to take unnecessary sick days, returning to work faster and more efficiently.

Moreover, combining this commitment to well-being with tangible financial benefits creates a powerful synergy. For instance, many small businesses in Dallas find they benefit from tax deductions on premiums paid for group health insurance plans. These deductions can significantly lower the overall cost of providing coverage, allowing businesses to reinvest those savings back into their operations or employee development programs instead. According to reports, some organizations have seen annual savings in the thousands simply by offering comprehensive health plans.

“Every dollar saved on employee health benefits means another dollar we can put towards innovation,” one Dallas employer commented.

On top of that, having group insurance can also enhance your company’s reputation. In competitive job markets like Dallas, prospective employees tend to favor organizations that offer comprehensive benefits packages when choosing where to work. This means an employer not only retains existing talent but also attracts high-caliber candidates who might otherwise seek opportunities elsewhere.

Recognizing these advantages empowers employers not just in recruitment efforts but also in cultivating a workplace environment that promotes growth and stability—a critical element in today’s competitive landscape. Let’s now navigate the specifics surrounding accessible and affordable options within this domain.

Affordable Coverage Options

When searching for affordable group health insurance in Dallas, it’s vital to recognize that not all plans are created equal. Employers need to investigate the specific coverage options to determine which plan provides the best value for their employees without breaking the bank. Each employer’s situation is different; therefore, flexibility is key. This includes understanding what each plan covers and how it aligns with both employee needs and business goals.

Imagine finding a plan so perfect that it feels like winning the health insurance lottery! That’s the kind of thrill employers should aim for, but it requires careful comparison and analysis of available options.

It’s also good practice to consider employee demographic factors when evaluating plans. For instance, if most of your staff is younger and healthier, a plan with lower premiums and higher deductibles might fit well.

Key Plans to Consider

Within the landscape of group health plans, there are several key types that employers should consider. Each has its perks and potential drawbacks.

One popular choice is the Health Maintenance Organization (HMO) plan, which typically offers lower premiums but requires members to choose a primary care physician and get referrals for specialists. This can lead to substantial savings but limits choices when seeking care. Alternatively, there are Preferred Provider Organization (PPO) plans that offer more flexibility by allowing members to visit any healthcare provider, though at a higher cost.

To truly decipher which type of plan will serve your employees best, try organizing a casual survey within your team. This feedback can be invaluable as it lets you gauge employee preferences regarding health coverage and assists in negotiating better terms with insurers.

However, understanding these details alone isn’t enough; evaluating potential insurers’ reputations and reliability is equally crucial.

Evaluating Insurer Reputation

An insurer’s track record regarding claim handling and customer service can end up being just as important as the coverage itself. Employees want assurance that their claims will be managed smoothly when they need healthcare services. So take time to review feedback from current or past clients. Online reviews, testimonials, and ratings from independent organizations can paint a clearer picture of an insurer’s reliability.

With this knowledge in hand, employers can confidently make informed decisions about which insurance provider offers the best combination of cost, coverage options, and service quality for their team’s unique needs.

While exploring these elements might feel overwhelming initially, remember that investing time upfront into finding suitable group health insurance can yield significant long-term benefits for both your business and employees alike. This proactive approach builds trust within your workforce and fosters overall job satisfaction.

Moving forward, understanding various plans tailored to different business sizes will provide further clarity in making this critical decision.

Types of Plans for Different Business Sizes

Different sizes of businesses in Dallas require different types of health plans tailored to their specific employee needs and financial capabilities. Small businesses, usually defined as those with fewer than 50 employees, often have unique challenges. They might lean towards Health Maintenance Organization (HMO) plans, which provide a structured framework where members must choose from a limited network of providers. This option can be appealing due to its cost-effectiveness. However, it does come with trade-offs: smaller businesses might find that the restrictive provider choice could be a potential downside for employees preferring more freedom in selecting healthcare professionals.

Moving onto larger businesses, they typically experience distinct demands and can absorb higher costs associated with broader coverage options.

Small Business Plans

For small businesses, HMOs can be very attractive due to lower premiums compared to other plan types. By keeping a tight network of providers and prioritizing preventative care, these plans are designed to maintain a comprehensive health management approach. However, it is crucial for owners to communicate clearly with employees about the limited choices of doctors and specialists within the HMO network, as dissatisfaction may arise if workers feel trapped by their healthcare options.

As we transition into discussing large business plans, it’s vital to understand how the scale influences not only the type of insurance but also the overall employee satisfaction and productivity.

Large Business Plans

For larger organizations with 50 or more employees, Preferred Provider Organization (PPO) plans often come into play. Versatile and accommodating, PPOs allow employees greater freedom to choose healthcare providers outside their network, although this convenience often results in higher premiums. Companies must weigh the benefits of enhanced provider access against budget constraints carefully; striking that balance can lead to better employee satisfaction and retention rates. Larger companies often see this aspect as a way to invest in talent by providing them with desirable healthcare options.

Understanding variations in plans based on business size opens up a deeper conversation about the financial components linked to your choices, crucial elements that determine the effectiveness and attractiveness of any insurance plan you might consider.

Key Features: Premiums, Co-pays, and Deductibles

When evaluating group health insurance plans, three critical elements always come to the forefront: premiums, co-pays, and deductibles. These components significantly influence both the cost to your business and the financial commitment required from employees. Let’s break them down further to uncover how each impacts overall affordability and accessibility of healthcare.

Starting with premiums, this is the amount you pay each month for your insurance coverage. Think of premiums as the gatekeeper to receiving medical care; they’re a necessary expense for accessing services when needed. Higher premiums streamline access by typically resulting in lower co-pays and deductibles—this means less money out of pocket when employees seek care. But remember, this comes with a trade-off: higher monthly costs can strain budgets, especially for smaller businesses. The decision here often boils down to what works best financially: can your organization shoulder the higher upfront costs, or would it be wiser to choose a plan with lower premiums and potentially higher out-of-pocket expenses?

Next in line are co-pays, which are fixed fees that employees pay for specific services, such as doctor visits or prescription medications.

Imagine a scenario where an employee needs to see a specialist regularly; if the co-pay is $20 each visit, that adds up over time. For someone who utilizes health services frequently, choosing a plan with lower co-pays might save more money in the long run compared to a plan with high premiums but lower co-pays. This balance is key. While high-deductible plans may appeal at first glance due to their lower monthly premium, it’s crucial to assess how often your staff accesses medical services and whether those fixed fees will affect their willingness to seek care.

Lastly, we have deductibles, which represent the amount an insured person pays out-of-pocket before their insurance begins to cover costs.

Deductibles can feel daunting; high-deductible plans often boast appealingly low monthly premiums but require attention. They mean that employees must bear more upfront costs before receiving insurance benefits. For businesses with many young or healthy employees who rarely utilize medical services, these plans could seem ideal. However, they pose risk if unexpected health issues arise—employees might find themselves unprepared to handle sudden medical costs without prior savings dedicated toward that deductible.

A good approach is understanding how each of these components interacts with your overall budgeting strategy and employee health needs. While higher premium plans often lead to lower co-pays and deductibles—a tempting balance—they may not always suit the diverse situations of your workforce.

Also consider employer-sponsored contributions towards these elements when evaluating the final design of your group health plan. How much support can you provide? Would it change employee behavior when utilizing their benefits?

Close monitoring of utilization rates can help establish a clearer picture over time, enabling revisions of coverage options as necessary—all while keeping employee satisfaction paramount.

With clarity on premiums, co-pays, and deductibles at hand, assessing which network providers can deliver quality care becomes essential as you continue to build effective health strategies for your employees.

Navigating Enrollment and Network Providers

Enrolling in a group health insurance plan may seem straightforward, but it can carry considerable weight in terms of the benefits you receive. Taking the time to understand each step of the enrollment process will minimize headaches later on.

First, gather all relevant employee information such as Social Security numbers, birthdays, and contact details. This initial preparation streamlines the enrollment process and prevents any delays during submission.

Once you’ve collected necessary information, you’ll need to choose a plan that aligns with both your budget and employees’ collective healthcare needs. This decision isn’t just about picking the first option; it involves weighing variables such as premiums, coverage options, and out-of-pocket costs. A careful evaluation ensures that everyone covered under the group plan feels secure in their health management.

After choosing a suitable plan, it’s time to fill out forms. Be thorough and accurate when completing and submitting documents to your chosen insurance provider. Any errors in this phase can lead to frustrating complications down the line.

Selecting Network Providers

The next significant consideration is selecting network providers associated with your chosen health insurance plan. Opting for insurers with expansive networks can significantly enhance access to quality healthcare services. For example, Blue Cross Blue Shield has an extensive array of healthcare providers in Dallas, offering various services across multiple specialties.

Look for features when evaluating network providers:

- Availability of Specialists: Ensure there are specialists available within the network for essential medical needs.

- Geographic Accessibility: Consider the location of providers and whether they are convenient for employees.

- Quality Ratings: Research quality ratings of network hospitals or practices to determine their service standards.

Overall, choosing network providers shouldn’t be an afterthought. Doing a little upfront research can lead to significant long-term benefits for your health coverage experience.

By understanding the enrollment steps and thoughtfully selecting network providers, you’ll position yourself well to optimize your group’s health insurance experience while maintaining a smooth workflow throughout the process.

In summary, taking these proactive measures will help ensure your selection of group health insurance plans in Dallas is both effective and beneficial for you and your team.

HEALTH

What Is a SLAP Tear? Understanding This Common Shoulder Injury

If you’ve been experiencing shoulder pain, clicking, or a loss of strength—especially during overhead movements—you may be dealing with more than just a strain. One possible culprit is a SLAP tear, a specific type of injury to the shoulder joint that can affect everyone from athletes to weekend warriors.

What Does “SLAP Tear” Mean?

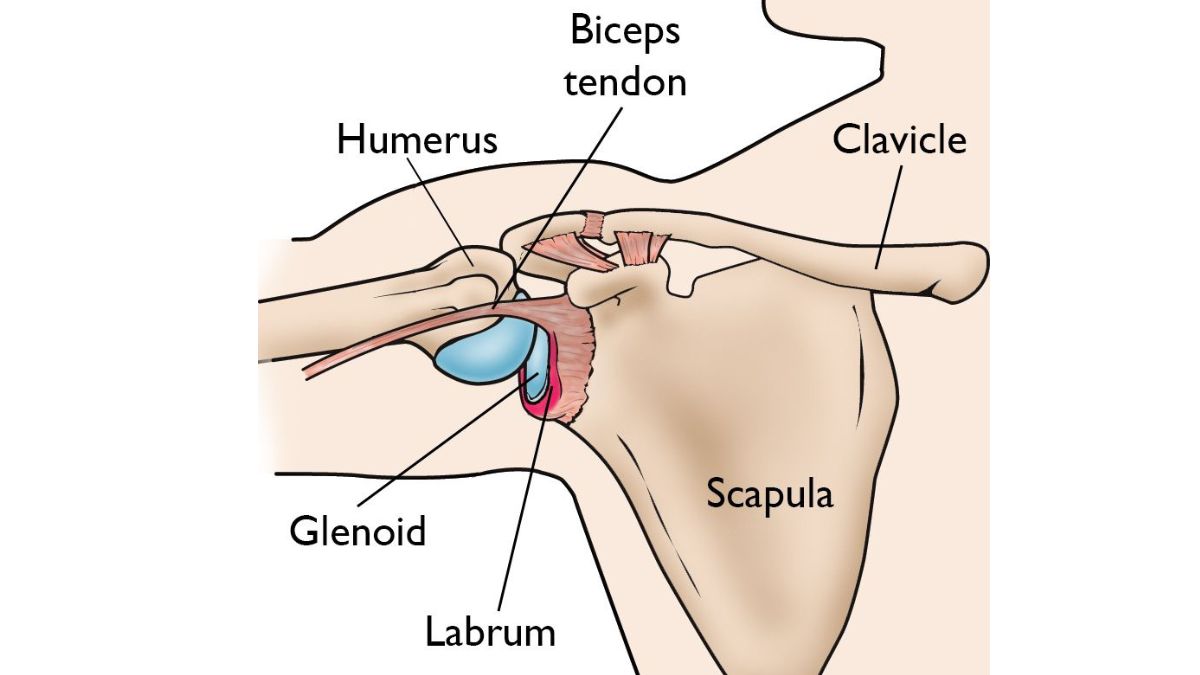

SLAP stands for Superior Labrum Anterior and Posterior. In simpler terms, it’s a tear in the top part of the labrum—the ring of cartilage that surrounds the socket of your shoulder joint. This cartilage helps stabilize your shoulder and keep the ball of your upper arm bone in place. When torn, the result can be instability, discomfort, and reduced mobility.

How Does a SLAP Tear Happen?

SLAP tears can result from either acute trauma or repetitive motion. Some of the most common causes include:

- Falling on an outstretched arm

- Lifting heavy objects or weights with poor form

- Repetitive overhead movements (common in baseball, swimming, tennis, etc.)

- Sudden pulling motions (like grabbing something while falling)

In some cases, SLAP tears can also be part of the natural wear-and-tear process, especially in people over 40.

Common Symptoms of a SLAP Tear

Not all SLAP tears feel the same, but here are some symptoms to watch for:

- Deep shoulder pain, especially during overhead activity

- A clicking or popping sensation

- Weakness or fatigue in the shoulder

- Limited range of motion

- A feeling that your shoulder is going to “slip out”

These symptoms often mimic other shoulder conditions, which is why getting an accurate diagnosis is so important.

Diagnosing a SLAP Tear

A shoulder specialist will typically begin with a physical exam and a review of your activity history. Imaging tests like an MRI can help confirm the diagnosis, though in some cases, an arthroscopic procedure may be necessary to fully visualize the tear.

For a deeper dive into how SLAP tears are diagnosed and treated, visit: https://levelupshoulder.com/slap-tears/

Treatment Options

Treatment depends on the severity of the tear and your activity level. In mild cases, rest, anti-inflammatory medications, and physical therapy may be enough to restore function. For more serious tears—especially in younger or highly active individuals—arthroscopic surgery may be recommended to repair the torn labrum.

Post-surgery, a rehabilitation program will help restore range of motion, rebuild strength, and reduce the risk of reinjury.

Don’t Ignore Shoulder Pain

A SLAP tear can seriously impact your ability to perform daily tasks and enjoy physical activity. If you’re experiencing persistent shoulder pain, especially with overhead movements, it’s worth getting it checked out. Early treatment leads to better outcomes and a quicker return to the things you love.

HEALTH

What Is Orthopedic Medicine? An Intro to Bone and Joint Health

From sore knees after a weekend hike to a torn rotator cuff that just won’t heal, many of us deal with bone, joint, or muscle pain at some point in our lives. That’s where orthopedic medicine comes in. But what exactly does it cover—and when should you see an orthopedic specialist?

Whether you’re an athlete, a weekend warrior, or simply want to stay mobile and pain-free as you age, understanding the basics of orthopedic care can help you make better decisions about your health.

What Is Orthopedic Medicine?

Orthopedic medicine is a branch of medicine focused on the musculoskeletal system, which includes your bones, joints, ligaments, tendons, muscles, and nerves. The goal is to diagnose, treat, and prevent injuries and disorders that affect movement, stability, and function.

Orthopedic specialists, also known as orthopedists or orthopedic surgeons, are trained to handle everything from acute injuries (like fractures and dislocations) to chronic conditions such as arthritis, tendonitis, and degenerative joint disease.

What Conditions Do Orthopedic Doctors Treat?

Orthopedic medicine covers a wide range of conditions affecting different areas of the body, including:

- Shoulder injuries: rotator cuff tears, labral tears, impingement

- Knee issues: ACL tears, meniscus injuries, runner’s knee, arthritis

- Spine problems: herniated discs, sciatica, scoliosis

- Hip pain: bursitis, labral tears, osteoarthritis

- Hand and wrist: carpal tunnel syndrome, fractures, tendonitis

- Foot and ankle: plantar fasciitis, sprains, Achilles tendon injuries

Many of these conditions can be treated with non-surgical methods, though surgery may be necessary in more severe cases.

Types of Orthopedic Care

Orthopedic care includes both surgical and non-surgical options, depending on the injury or condition. Treatment approaches may involve:

- Physical therapy and rehabilitation

- Injections (such as cortisone or PRP) to reduce inflammation and pain

- Bracing or casting for stability and healing

- Minimally invasive surgery, like arthroscopy

- Joint replacement surgery, typically for hips, knees, or shoulders

For example, orthopedic treatments by Level Up Shoulder, Dr. Drake focus not only on surgical repair of shoulder injuries, but also on functional rehab, strength restoration, and getting patients back to the activities they love—faster and stronger.

When Should You See an Orthopedic Doctor?

If you’re experiencing any of the following, it may be time to schedule a consultation:

- Persistent joint or muscle pain

- Swelling or stiffness that doesn’t improve with rest

- Limited range of motion in a joint

- Weakness or instability

- An injury that isn’t healing properly

- Pain that interferes with your daily life or sleep

Early intervention can prevent long-term damage and get you back to full strength sooner.

Conclusion

Orthopedic medicine plays a vital role in keeping your body moving the way it should. Whether you’ve suffered a sports injury or are dealing with years of wear and tear, orthopedic specialists are trained to help you regain mobility, reduce pain, and improve your quality of life.

From preventive care to advanced surgical procedures, orthopedic treatments are designed to keep your bones and joints working better, for longer.

HEALTH

Raising Healthy Smiles: The Essentials of Pediatric Dental Care

What Is Pediatric Dentistry?

In addition to providing dental care, pediatric dentistry promotes good oral hygiene from an early age. Unlike general dentistry, pediatric dentists focus on young patients’ unique challenges and considerations. Their specific training prepares them to prevent and treat oral health problems in newborns, kids, and teenagers. Facilities like a Pediatric Dentist in Thornton provide environments specifically designed for children, helping ease anxiety and making dental visits enjoyable experiences. A pediatric facility’s vibrant and entertaining surroundings can significantly influence a child’s desire to get dental care.

The Importance of Early Dental Visits

Starting dental visits early is an investment in lifelong oral health. These initial visits, as recommended by the American Academy of Pediatric Dentistry, set the stage for understanding the importance of dental care. These are crucial periods when dentists can introduce children to oral hygiene and the significance of caring for their teeth. By capturing a child’s interest and removing any fear associated with dental visits, these experiences contribute to effectively monitoring and guiding the development of both baby and permanent teeth.

Understanding Common Pediatric Dental Issues

Children’s dental problems, including cavities and gum disease, are sometimes written off as trivial, but if ignored, they can cause serious health problems. Children are prone to cavities due to the sugary foods they consume and their sometimes irregular brushing habits. In addition, behaviors like thumb-sucking and extended use of pacifiers can affect tooth alignment and jaw development. By attending regular dental visits, parents can gain insights from dental professionals on mitigating these risks and ensuring early intervention. A more secure oral future can result from early detection of these disorders, which can stop them from developing into more serious tooth health difficulties.

Tips for Promoting Healthy Dental Habits

Creating a routine around dental care can help instill lifelong habits in children. They must be taught to use fluoride toothpaste and clean their teeth twice daily. Flossing should also be incorporated once teeth begin to touch. These habits need reinforcement at home to foster a sense of accountability in children. Parents can use visual aids or reward systems as positive reinforcements. Demonstrating proper techniques adds value, as children are likely to imitate the actions they observe. Good oral hygiene should be framed positively as an empowering practice rather than a chore.

Nutrition’s Role in Oral Health

A balanced diet is a pillar of strong oral health. Foods containing essential minerals, particularly calcium and phosphorus, are crucial in maintaining healthy enamel and oral well-being. Nuts, leafy greens, and dairy products can all significantly improve tooth health when consumed regularly. It’s also critical to restrict the consumption of acidic drinks and sugary foods that cause cavities. The resource on WebMD highlights the importance of a balanced diet in protecting your child’s teeth. Making informed choices about diet is an impactful way for parents to exercise control over their child’s oral health outside of the dental office.

How to Choose the Right Pediatric Dentist

Choosing a pediatric dentist shouldn’t be rushed. It’s a decision that can influence a child’s view of dental care. A pediatric dentist’s ability to communicate effectively with children and a friendly, inviting office atmosphere can make visits less intimidating. You could feel more at ease reading online reviews or asking friends for recommendations. The right dentist will engage with children in a way that builds trust and encourages enthusiasm for dental care. Parents are encouraged to visit potential dental practices to assess the environment and ensure it aligns with their child’s comfort levels and needs.

Setting Up a Child-Friendly Dental Routine

Making dental hygiene a habitual, positive practice begins with creativity. Utilizing tools such as songs, colorful toothbrushes, or even digital apps tracking brushing time can turn routine into fun. Allowing your child to pick out their dental supplies can also foster a sense of ownership over their oral hygiene. Establishing a routine, like brushing after breakfast and before bed, helps to weave dental care seamlessly into daily life. Consistency is key, and positive reinforcement can encourage a child to see these activities as enjoyable and rewarding.

Navigating Dental Anxiety in Children

Dental anxiety can significantly impact a child’s willingness to receive care, but it can be managed successfully. Introducing your child to the dental office gradually and supportively can alleviate fear. Explaining dental procedures using child-friendly language and offering reassurance can demystify the experience. Techniques such as deep breathing exercises or storytelling can divert attention, making visiting less daunting. Creating a supportive environment at home and during dental visits cultivates a positive attitude toward long-term dental wellness.

-

BLOG1 year ago

BLOG1 year agoATFBooru: A Hub for Animated Art and Community

-

CONSTRUCTION1 year ago

CONSTRUCTION1 year agoBuilding a Home Gym in Your Basement (7 Key Renovation Tips)

-

BLOG1 year ago

BLOG1 year agoFictionmania: A Deep Dive into the World of Transformative Stories

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoVersatile Living: Stylish Indoor Outdoor Rugs with Eco-Friendly Appeal

-

GAMES1 year ago

GAMES1 year agoSnow Rider 3D: Unblocked Tips and Tricks for Gamers

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoAchieve Elegance with Chic Blue Formal Dresses and Redken Professional Hair Care for All Hair Types

-

BLOG1 year ago

BLOG1 year agoGIFHQ: A Comprehensive Guide

-

BLOG1 year ago

BLOG1 year agoVincent herbert new wife: A Detailed Overview