HEALTH

The Art of Keeping Your Eyes Healthy: Tips and Insights

Why Eye Health Matters

Our eyes are essential sensory organs, providing greater insight into the world around us than any other sense. They are pivotal in daily communication, coordination, and interaction with our surroundings. Prioritizing their health is crucial, yet regular eye exams often take a backseat in personal healthcare routines. It’s common to postpone or avoid appointments until vision alterations become noticeable. Despite this tendency, institutions like Andover Family Optometry underscore the importance of consistent check-ups, as they are critical in detecting conditions before they escalate. According to current estimates from agencies such as the Centers for Disease Control and Prevention, almost 12 million Americans aged 40 and up are visually impaired.

Furthermore, regular eye exams can identify systemic health issues like hypertension and diabetes, often reflected through ocular changes. Recognizing these when subtle is beneficial for early interventions, potentially preventing severe complications. For instance, diabetic retinopathy can lead to blindness if not detected early. During periodic exams, optometrists not only prescribe visual aids but also assess overall eye health, providing vital information on maintaining optimal vision.

Preventive Care Routines

Preventive eye care involves adopting practices that safeguard vision over the years. Scheduling regular eye check-ups forms the foundation of this strategy. These evaluations allow healthcare professionals to establish a baseline for your vision and identify deviations promptly. Adults should undergo a comprehensive dilated eye exam every one to two years.

Preventive care extends beyond clinic visits. It includes adopting a protective lifestyle against everyday eye stressors. Wearing sunglasses with UVA and UVB protection defends the eyes from harmful rays, lowering the incidence of cataracts and macular degeneration. Minuscule preventive actions, when accumulated over a lifetime, substantially reduce the risk of eye conditions and enhance overall visual quality.

Daily Habits for Better Vision

Daily habits play a significant role in supporting or harming eye health. Nutrition, for instance, is vital, as much as it is often overlooked within the context of vision. Foods substantial in antioxidants, such as leafy greens and omega-3 fatty acid-rich seafood, help to maintain retinal health, but excessive sugar consumption increases the risk of diabetic eye disease. Proper hydration is also essential for maintaining the moisture balance of the eyes, which is necessary to guard against dryness and irritation.

Screen time presents a modern challenge in our increasingly digital world, often leading to digital eye strain. Implementing the 20-20-20 rule—every 20 minutes, look at something 20 feet away for 20 seconds—provides much-needed relief. Maintaining an ergonomic workstation setup also helps alleviate physical strain on the eyes and body. These habits collectively ensure that visual health is preserved amidst daily activities. The American Academy of Ophthalmology offers a detailed guide to common behaviors that improve eye health.

Technological Advancements

Technological advancements have transformed the field of eye care, providing more precise and varied treatment options. OCT, a sophisticated diagnostic tool, generates detailed cross-sectional images of the retina, facilitating the early detection of conditions like AMD. Such tools pave the way for prompt treatment and better prognosis.

Innovative materials in eyewear design have also emerged. Lenses now cater to specific needs, including blocking blue light to mitigate screen exposure effects. Integrating technology into daily wearables, such as smart contact lenses, signifies a future where eye care adapts to and anticipates individual needs. Staying informed about these advancements empowers individuals to make knowledgeable decisions about their eye health care options.

Consulting Experts

Professional consultations remain central to effective eye care. Optometrists and ophthalmologists provide tailored advice based on detailed assessments of individual eye health, lifestyle, and genetic predispositions. They help patients understand the best practices in vision care, including corrective options and habit recommendations.

Regular expert consultation ensures that any vision changes are addressed promptly. Many eye disorders, such as glaucoma, progress silently, with no visible signs until permanent damage occurs. Consistent professional advice is a valuable tool in proactively managing eye health, ensuring not just the correction of vision anomalies but the comprehensive preservation of health. This approach underscores the vital bond between clinical expertise and long-term eye wellness, assuring that your eyes receive the best possible care throughout every stage of life.

HEALTH

What Is a SLAP Tear? Understanding This Common Shoulder Injury

If you’ve been experiencing shoulder pain, clicking, or a loss of strength—especially during overhead movements—you may be dealing with more than just a strain. One possible culprit is a SLAP tear, a specific type of injury to the shoulder joint that can affect everyone from athletes to weekend warriors.

What Does “SLAP Tear” Mean?

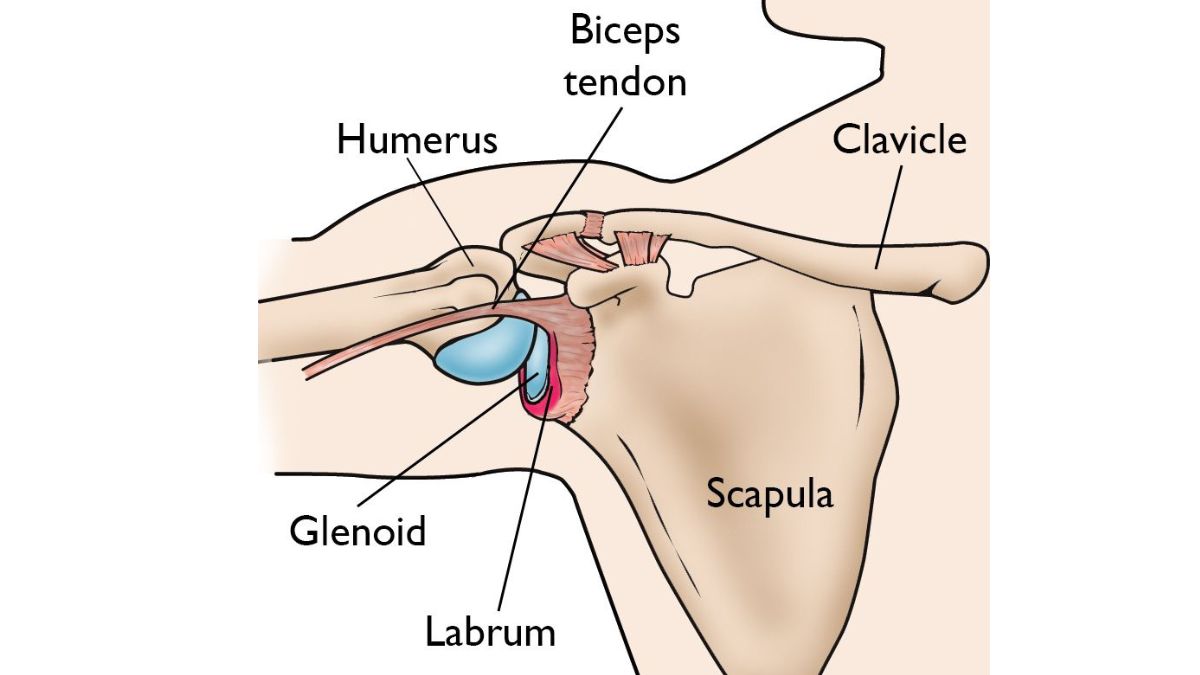

SLAP stands for Superior Labrum Anterior and Posterior. In simpler terms, it’s a tear in the top part of the labrum—the ring of cartilage that surrounds the socket of your shoulder joint. This cartilage helps stabilize your shoulder and keep the ball of your upper arm bone in place. When torn, the result can be instability, discomfort, and reduced mobility.

How Does a SLAP Tear Happen?

SLAP tears can result from either acute trauma or repetitive motion. Some of the most common causes include:

- Falling on an outstretched arm

- Lifting heavy objects or weights with poor form

- Repetitive overhead movements (common in baseball, swimming, tennis, etc.)

- Sudden pulling motions (like grabbing something while falling)

In some cases, SLAP tears can also be part of the natural wear-and-tear process, especially in people over 40.

Common Symptoms of a SLAP Tear

Not all SLAP tears feel the same, but here are some symptoms to watch for:

- Deep shoulder pain, especially during overhead activity

- A clicking or popping sensation

- Weakness or fatigue in the shoulder

- Limited range of motion

- A feeling that your shoulder is going to “slip out”

These symptoms often mimic other shoulder conditions, which is why getting an accurate diagnosis is so important.

Diagnosing a SLAP Tear

A shoulder specialist will typically begin with a physical exam and a review of your activity history. Imaging tests like an MRI can help confirm the diagnosis, though in some cases, an arthroscopic procedure may be necessary to fully visualize the tear.

For a deeper dive into how SLAP tears are diagnosed and treated, visit: https://levelupshoulder.com/slap-tears/

Treatment Options

Treatment depends on the severity of the tear and your activity level. In mild cases, rest, anti-inflammatory medications, and physical therapy may be enough to restore function. For more serious tears—especially in younger or highly active individuals—arthroscopic surgery may be recommended to repair the torn labrum.

Post-surgery, a rehabilitation program will help restore range of motion, rebuild strength, and reduce the risk of reinjury.

Don’t Ignore Shoulder Pain

A SLAP tear can seriously impact your ability to perform daily tasks and enjoy physical activity. If you’re experiencing persistent shoulder pain, especially with overhead movements, it’s worth getting it checked out. Early treatment leads to better outcomes and a quicker return to the things you love.

HEALTH

What Is Orthopedic Medicine? An Intro to Bone and Joint Health

From sore knees after a weekend hike to a torn rotator cuff that just won’t heal, many of us deal with bone, joint, or muscle pain at some point in our lives. That’s where orthopedic medicine comes in. But what exactly does it cover—and when should you see an orthopedic specialist?

Whether you’re an athlete, a weekend warrior, or simply want to stay mobile and pain-free as you age, understanding the basics of orthopedic care can help you make better decisions about your health.

What Is Orthopedic Medicine?

Orthopedic medicine is a branch of medicine focused on the musculoskeletal system, which includes your bones, joints, ligaments, tendons, muscles, and nerves. The goal is to diagnose, treat, and prevent injuries and disorders that affect movement, stability, and function.

Orthopedic specialists, also known as orthopedists or orthopedic surgeons, are trained to handle everything from acute injuries (like fractures and dislocations) to chronic conditions such as arthritis, tendonitis, and degenerative joint disease.

What Conditions Do Orthopedic Doctors Treat?

Orthopedic medicine covers a wide range of conditions affecting different areas of the body, including:

- Shoulder injuries: rotator cuff tears, labral tears, impingement

- Knee issues: ACL tears, meniscus injuries, runner’s knee, arthritis

- Spine problems: herniated discs, sciatica, scoliosis

- Hip pain: bursitis, labral tears, osteoarthritis

- Hand and wrist: carpal tunnel syndrome, fractures, tendonitis

- Foot and ankle: plantar fasciitis, sprains, Achilles tendon injuries

Many of these conditions can be treated with non-surgical methods, though surgery may be necessary in more severe cases.

Types of Orthopedic Care

Orthopedic care includes both surgical and non-surgical options, depending on the injury or condition. Treatment approaches may involve:

- Physical therapy and rehabilitation

- Injections (such as cortisone or PRP) to reduce inflammation and pain

- Bracing or casting for stability and healing

- Minimally invasive surgery, like arthroscopy

- Joint replacement surgery, typically for hips, knees, or shoulders

For example, orthopedic treatments by Level Up Shoulder, Dr. Drake focus not only on surgical repair of shoulder injuries, but also on functional rehab, strength restoration, and getting patients back to the activities they love—faster and stronger.

When Should You See an Orthopedic Doctor?

If you’re experiencing any of the following, it may be time to schedule a consultation:

- Persistent joint or muscle pain

- Swelling or stiffness that doesn’t improve with rest

- Limited range of motion in a joint

- Weakness or instability

- An injury that isn’t healing properly

- Pain that interferes with your daily life or sleep

Early intervention can prevent long-term damage and get you back to full strength sooner.

Conclusion

Orthopedic medicine plays a vital role in keeping your body moving the way it should. Whether you’ve suffered a sports injury or are dealing with years of wear and tear, orthopedic specialists are trained to help you regain mobility, reduce pain, and improve your quality of life.

From preventive care to advanced surgical procedures, orthopedic treatments are designed to keep your bones and joints working better, for longer.

HEALTH

Raising Healthy Smiles: The Essentials of Pediatric Dental Care

What Is Pediatric Dentistry?

In addition to providing dental care, pediatric dentistry promotes good oral hygiene from an early age. Unlike general dentistry, pediatric dentists focus on young patients’ unique challenges and considerations. Their specific training prepares them to prevent and treat oral health problems in newborns, kids, and teenagers. Facilities like a Pediatric Dentist in Thornton provide environments specifically designed for children, helping ease anxiety and making dental visits enjoyable experiences. A pediatric facility’s vibrant and entertaining surroundings can significantly influence a child’s desire to get dental care.

The Importance of Early Dental Visits

Starting dental visits early is an investment in lifelong oral health. These initial visits, as recommended by the American Academy of Pediatric Dentistry, set the stage for understanding the importance of dental care. These are crucial periods when dentists can introduce children to oral hygiene and the significance of caring for their teeth. By capturing a child’s interest and removing any fear associated with dental visits, these experiences contribute to effectively monitoring and guiding the development of both baby and permanent teeth.

Understanding Common Pediatric Dental Issues

Children’s dental problems, including cavities and gum disease, are sometimes written off as trivial, but if ignored, they can cause serious health problems. Children are prone to cavities due to the sugary foods they consume and their sometimes irregular brushing habits. In addition, behaviors like thumb-sucking and extended use of pacifiers can affect tooth alignment and jaw development. By attending regular dental visits, parents can gain insights from dental professionals on mitigating these risks and ensuring early intervention. A more secure oral future can result from early detection of these disorders, which can stop them from developing into more serious tooth health difficulties.

Tips for Promoting Healthy Dental Habits

Creating a routine around dental care can help instill lifelong habits in children. They must be taught to use fluoride toothpaste and clean their teeth twice daily. Flossing should also be incorporated once teeth begin to touch. These habits need reinforcement at home to foster a sense of accountability in children. Parents can use visual aids or reward systems as positive reinforcements. Demonstrating proper techniques adds value, as children are likely to imitate the actions they observe. Good oral hygiene should be framed positively as an empowering practice rather than a chore.

Nutrition’s Role in Oral Health

A balanced diet is a pillar of strong oral health. Foods containing essential minerals, particularly calcium and phosphorus, are crucial in maintaining healthy enamel and oral well-being. Nuts, leafy greens, and dairy products can all significantly improve tooth health when consumed regularly. It’s also critical to restrict the consumption of acidic drinks and sugary foods that cause cavities. The resource on WebMD highlights the importance of a balanced diet in protecting your child’s teeth. Making informed choices about diet is an impactful way for parents to exercise control over their child’s oral health outside of the dental office.

How to Choose the Right Pediatric Dentist

Choosing a pediatric dentist shouldn’t be rushed. It’s a decision that can influence a child’s view of dental care. A pediatric dentist’s ability to communicate effectively with children and a friendly, inviting office atmosphere can make visits less intimidating. You could feel more at ease reading online reviews or asking friends for recommendations. The right dentist will engage with children in a way that builds trust and encourages enthusiasm for dental care. Parents are encouraged to visit potential dental practices to assess the environment and ensure it aligns with their child’s comfort levels and needs.

Setting Up a Child-Friendly Dental Routine

Making dental hygiene a habitual, positive practice begins with creativity. Utilizing tools such as songs, colorful toothbrushes, or even digital apps tracking brushing time can turn routine into fun. Allowing your child to pick out their dental supplies can also foster a sense of ownership over their oral hygiene. Establishing a routine, like brushing after breakfast and before bed, helps to weave dental care seamlessly into daily life. Consistency is key, and positive reinforcement can encourage a child to see these activities as enjoyable and rewarding.

Navigating Dental Anxiety in Children

Dental anxiety can significantly impact a child’s willingness to receive care, but it can be managed successfully. Introducing your child to the dental office gradually and supportively can alleviate fear. Explaining dental procedures using child-friendly language and offering reassurance can demystify the experience. Techniques such as deep breathing exercises or storytelling can divert attention, making visiting less daunting. Creating a supportive environment at home and during dental visits cultivates a positive attitude toward long-term dental wellness.

-

BLOG1 year ago

BLOG1 year agoATFBooru: A Hub for Animated Art and Community

-

CONSTRUCTION1 year ago

CONSTRUCTION1 year agoBuilding a Home Gym in Your Basement (7 Key Renovation Tips)

-

BLOG1 year ago

BLOG1 year agoFictionmania: A Deep Dive into the World of Transformative Stories

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoVersatile Living: Stylish Indoor Outdoor Rugs with Eco-Friendly Appeal

-

GAMES1 year ago

GAMES1 year agoSnow Rider 3D: Unblocked Tips and Tricks for Gamers

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoAchieve Elegance with Chic Blue Formal Dresses and Redken Professional Hair Care for All Hair Types

-

BLOG1 year ago

BLOG1 year agoGIFHQ: A Comprehensive Guide

-

BLOG1 year ago

BLOG1 year agoVincent herbert new wife: A Detailed Overview